Gucci coup a sign of why Edinburgh is bouncing when other cities are struggling

The rise of the luxury brand 'gallery' store, the role of tourism and an unexpected slice of luck

There will be no fanfare when it comes.

No flashy window displays, no showbusiness razzmatazz, and definitely no gaudy ‘coming soon’ signs. Five simple letters on a plain background - or even just those two famous interlocking Gs - will do.

When you are Gucci, you don’t need to shout about it.

Founded as a single shop in Florence, in 1921, selling handbags crafted by artisan leather workers, the Italian design house grew into one of luxury fashion’s global super brands. Endorsed by celebrities from Grace Kelly and Princess Diana to Serena Williams and Harry Styles, and with annual sales of more than £9bn, its allure has spanned decades from the days of La Dolce Vita to those of Love on Tour.

With a new creative director in the shape of Sabato de Sarno - the man credited with turning the vibrant ‘Valentino pink’ into last year’s new black - Gucci has bold ambitions to expand its empire still further.

One of its next standalone stores - and its first in the UK outside of London - will open on Multrees Walk, Edinburgh’s luxury ‘fashion village’, running alongside Harvey Nichols department store off St Andrew Square. No opening date has yet been set, in fact, nothing has been officially confirmed, but excitement is mounting at the move and what it could mean for Scotland’s Capital.

The fact that, with most of the world to choose from, the fashion giant chose Edinburgh for its next flagship store is a fascinating sign of the city’s place in the post-Covid world and the direction in which it is heading.

The ‘art galleries’ of shopping

If watching Lady Gaga starring in the House of Gucci biopic is the closest you have come to the inside of a high-end luxury store, then an introduction is in order.

A Gucci store is not a shop in the sense that most of us normally understand the word.

Entering a Gucci outlet is, of course, an ‘A-list’ experience. It is all about stepping into - for a short time at least - the world of the brand’s celebrity devotees. This is shopping like Gwyneth Paltrow, Rihanna, Kendall Jenner and Jared Leto do it. This is shopping like the super-rich do it in Hollywood movies. It is about wandering around a shop like it was an art gallery, it is shopping as a theatrical experience.

If you do head for the store once it opens, don’t expect the hard sell from the consciously understated staff, but do expect your credit card to do some heavy lifting. Gucci handbags start at £625 and go up in price to £35,130, fashion this high-end is not for the fainthearted. That, of course, is one of the reasons why there is such a flourishing secondhand market for Gucci and similar labels, not forgetting the ever-present one for counterfeits.

Hey big spender

So who should we expect to see leaving Multrees Walk laden down with shopping bags? Who are these people with seemingly recession-proof wallets and purses?

Gucci shoppers tend to be much more diverse than the cliche of the footballers’ wives and super-rich keen to flaunt their wealth. Sure, they are likely to be there, but many save up to invest in a single item to add sparkle to their whole special occasion wardrobe.

With an expanded product line including handbags, shoes, fashion, accessories and home decorations, as well as a Gucci Beauty range of perfumes and cosmetics, sales almost trebled between 2015 and 2019, while profits increased almost fourfold.

Much of this pre-Covid success was turbo-charged by one particular type of shopper, a familiar sight on the streets of Edinburgh and other fashionable European Capitals. Young, well-heeled Chinese travellers spent big and in large numbers on luxury fashion labels during their visits to Europe. As flights from Asia to Edinburgh return, those visitors are expected in larger numbers once again in the city.

The return of tourists from the United States heading to Scotland’s golf coast will provide further label conscience customers.

Just the anticipation of Gucci’s arrival means another two luxury brands are understood to be lining up moves to Multrees Walk. On the same street, Louis Vuitton is currently expanding its own standalone store. The luxury fashion village is growing.

Death of the department store

As our habits change in the age of Amazon and out-of-town shopping, the demise of the traditional department store is dramatically altering the face of city centres across Britain.

Up and down the country, these old palaces of consumerism that ruled the high street for more than a century are lying empty and forlorn, leaving yawning gaps in the middle of once busy shopping districts.

You can see the toll that large empty shop units are taking in cities up and down Scotland. Sauchiehall Street, once the bustling heart of many a Saturday afternoon shopping trip to Glasgow, is a sad and quiet reflection of its thriving past. In Aberdeen the loss of John Lewis has been felt hard, and the question of what to do to breathe new life into the grand boulevard of Union Street is the focus of much energy and angst.

They are not unusual compared to most cities up and down the UK, and will no doubt find their own ways to bounce back over time.

That is not the case in Edinburgh. You see this is not a story of the shopping district for the wealthy doing ‘very well thank you very much’ while the rest of the city suffers.

Wander around the city centre from the West End to the St James Quarter, take in every street in the traditional New Town shopping area and every floor of the new £1bn shopping mall, and you will find little more than 10 units without either a tenant or redevelopment planned. That is quite remarkable in the current economic climate and all the rapid changes on the high street.

The opening of the Vacheron Constantin luxury watch boutique on Frederick Street shows that even in the high fashion stakes it is not one-way traffic towards the St James.

Princes Street may look a little shabby and downtrodden in parts, but that is largely down to the exit of major stores - including Jenners, Zara, Next and Debenhams - and the gap in time until planned regeneration work takes place, including two major new hotels.

It is Edinburgh that is the outlier here, bucking a trend that has hit pretty much every other UK city, apart from London and Manchester.

Bucking the trend

There is no doubt that Edinburgh is faring far better than most UK cities right now - and it is not just a case of the new St James Quarter packing in the visitors and the rest of the city centre struggling as many feared might happen.

So how has the city managed to bounce back so quickly from lockdown when so many others are struggling? What makes Edinburgh different?

“There is no doubt the St James Quarter opening has given the city a massive shot in the arm,” says James Godfrey, a partner at the leading commercial property consultants Culverwell.

“In the UK, there are not many cities that have a £1bn mixed use development opening, with new retail brands, new restaurants and leisure opportunities, just as we were coming out of lockdown. The footfall has grown and grown and continues to grow.

“What it has done is increase the catchment area for Edinburgh as a shopping destination. People are now coming in from Glasgow, Aberdeen, Inverness and Newcastle.”

People who are coming to the city for other reasons - to see a show or a concert, see the sights or to work - are now more likely to extend their stay knowing they can do some serious shopping too.

Other factors come into play. The city’s enduring pulling power as a tourist destination is one, another is its unusual geography. A compact city, largely hemmed in by the coast and the Pentland hills, the limited opportunities for out-of-town shopping and leisure developments was long seen as an obstacle to its growth. Instead, today, that means it is the nearby attractions competing with the revitalised city centre that are limited.

“That is now an advantage. It was a stroke of luck.”

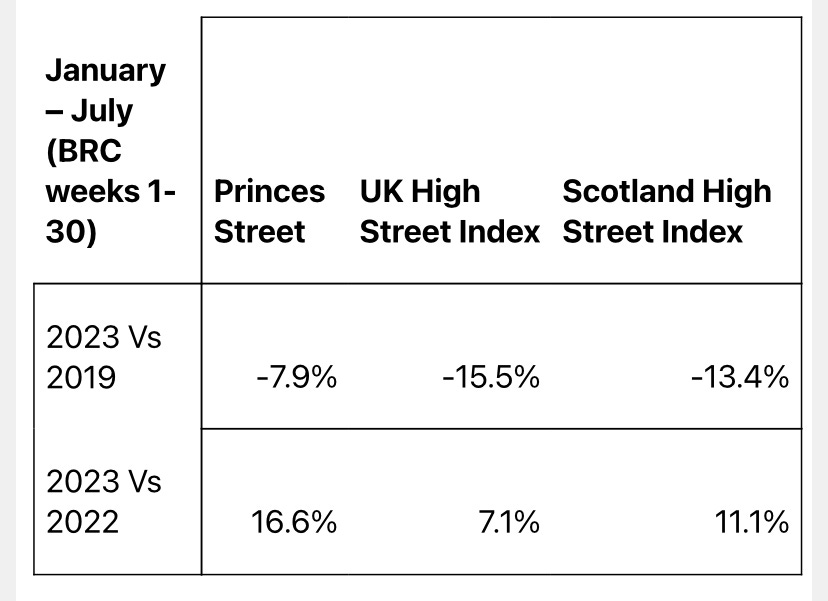

The proof as always is in the pudding. Retail sales covering all types of stores big and small across the entire city centre are outperforming most other UK cities, up 12.7% over the last 12 months compared to the previous year. That compares to 6.4% across Scotland as a whole and a UK average of just 3.9%. The pattern is similar for visitor numbers, or footfall, in Edinburgh compared to elsewhere.

Footfall rising faster on Princes Street

Barcelona not Birmingham

Attracting leading global brands like Gucci is “hugely significant” for Edinburgh, says Godfrey, showing that it can now compete with the great cities on the Continent in the retail stakes as well as in terms of history and culture.

“Edinburgh is not trying to compete with Manchester and Birmingham. It is competing with Amsterdam, Barcelona and Vienna, all those great European cities and Capital cities. Edinburgh is very much on that stage.”

The cities compete with each other not only to attract visitors of course but also for investment from leading retailers. That is why having both Gucci and Louis Vuitton choose Edinburgh for standalone stores - as opposed to concessions like the one that has operated successfully in Edinburgh’s Harvey Nichols for years - is such a big deal.

“These are significant brands that others follow. They might prefer the style of buildings in George Street, but when their people go back the number one question their board is going to ask is where are they (Gucci and Louis Vuitton) because I want to be on that street.”

Tourism ‘saving the city’

“Tourism has been the saviour in many ways,” says Roddy Smith, chief executive of Essential Edinburgh, the city centre management company.

“I would hate to think what would have happened to the city if we didn't have the number of tourists that we do. We'd be having a vastly different discussion about the state of Princess St and George Street, because all the good things that are coming in are driven by tourism. It's not absolutely 100% about tourism, but pretty significantly it is, especially the hotels.”

Tourism and hospitality has been the driver behind the regeneration of St Andrew Square, including the Gleneagles Townhouse, Edinburgh Grand and restaurants including Dishoom, the Ivy and Hawksmoor.

The arrival of Gucci is also largely driven by tourism and adds to the mix of what is on offer to everyone visiting the city centre.

“It just shows that that these brands take Edinburgh seriously as an international destination for high spending tourists, so it’s very positive. The one issue around that, and it's a UK issue, is about tax free shopping. The government in its infinite wisdom has stopped tax free shopping which hits the likes of Gucci, Mulberry, Strathberry, all the top end brands.

“It makes the UK less attractive than Paris, Berlin, Barcelona or Madrid because tourists don't get their tax back on their shopping. That's something that we're trying really hard, working with colleagues in London and elsewhere, to try and change.”

The St James Quarter

The opening of the St James Quarter has transformed shopping in Edinburgh in significant ways.

After previous attempts to establish late opening for shops as a routine part of Edinburgh life ultimately fell flat, that has now happened. Shops are routinely open until 8pm or later, spurred by the large number of people visiting the centre to eat and drink in its many restaurants and bars.

It has come a long way in a short time. It is easy to forget how strange its opening was in June, 2021 - perhaps the first ever for a major shopping destination that was not designed to attract large crowds from day one, due to the ongoing restrictions of the Covid crisis.

In its early days it attracted a large proportion of younger shoppers, as they were the first to venture back out and start enjoying the city again after lockdown. Today, the profile of visitors is much more mixed with the wide range of ‘best of high street’ shops and restaurants, many operating in Scotland for the first time and likely to remain exclusive to Edinburgh.

The thing that perhaps most pleases Martin Perry, the man responsible for delivering the £1bn project against the uncertainty of the Scottish Independence Referendum, Brexit and then Covid, is not so much what has happened on site as what has happened off it.

Dire warnings about the impact on the rest of the city centre have largely failed to materialise. The number of visitors to Princes Street, for example, is rising in line with those to the St James, which is seeing footfall rise each week by anywhere from 15% to 18% compared to last year. While large units are empty on Princes Street, plans are in place for most.

The new development which might have felt like it had been dumped on an unwilling city centre, an alien concept that didn’t quite fit, has instead quickly become a part of it, a new neighbourhood which people walk through like any other.

Perry, Managing Director of Development in Europe for the centre’s owners Nuveen, who now also oversee the neighbouring Omni Centre and Multrees Walk, said: “That is something that we worked very hard at, targeting particular retailers that brought something new to the city and deliberately not targeting others who were already operating elsewhere.

“We wanted to make sure that we brought something additional to the city rather than just moving things around.”

Nuveen and Perry recognised that the success of the St James rested on the wider success of the city, one could not and cannot reach its potential without taking the other along with it.

The success of its integration into the wider city can be measured perhaps by the fact that delivery drivers coming to neighbouring streets, such as West Register Street, technically outside the shopping centre development, can now be directed without any confusion to ‘the St James Quarter’.

The St James itself is on course to attract 20 million visitors this year, up from 17 million last, with growth still likely as the W Hotel - known to some as the walnut whip - is yet to open and residents are yet to move into the homes on the upper floors.

The end of major roadworks on North Bridge and Leith Walk has made a big difference, seeing a 56 per cent increase in the number of vehicles using its vast underground car park compared to last year.

The result has been a largely positive response from shoppers and retailers.

“We’re seeing a number of our retailers saying they are seeing trading densities (sales per square foot) that are the best in Europe. They are seeing it trading incredibly strongly compared to other locations.

“I’m not saying that they are massively outperforming target, but it’s doing very well, and other cities have not reacted so well. ”

“The reviews that we are getting from visitors are very positive - they are saying things like ‘nice atmosphere’ and very airy - which is great. The complaints that we get as such are about things like there are not enough toilets and the signage could be better. People always say the signage could be better even when it is brilliant.”